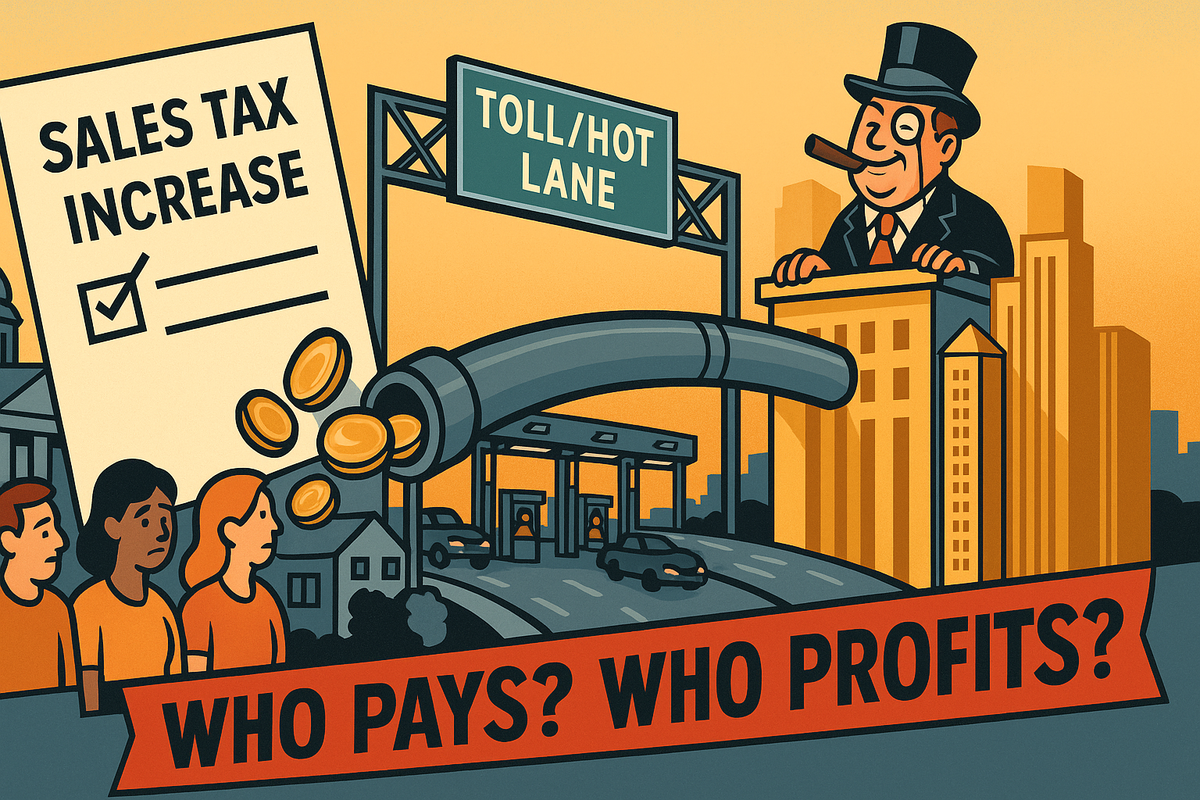

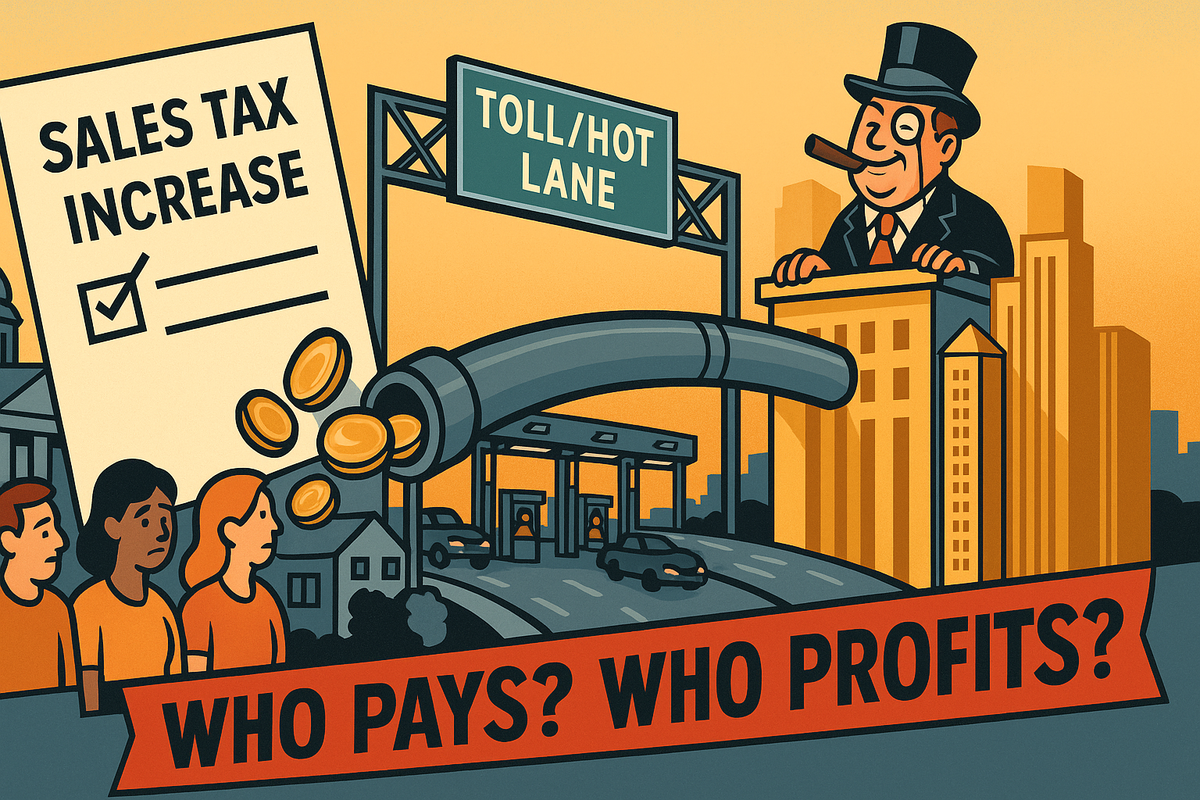

Newsom signs Asm. Nguyen's AB 1223, expanding STA's ability to seek sales tax hikes

Since 2016, the STA has made two efforts to raise sales taxes countywide for funding several transportation projects.

Since 2016, the STA has made two efforts to raise sales taxes countywide for funding several transportation projects.

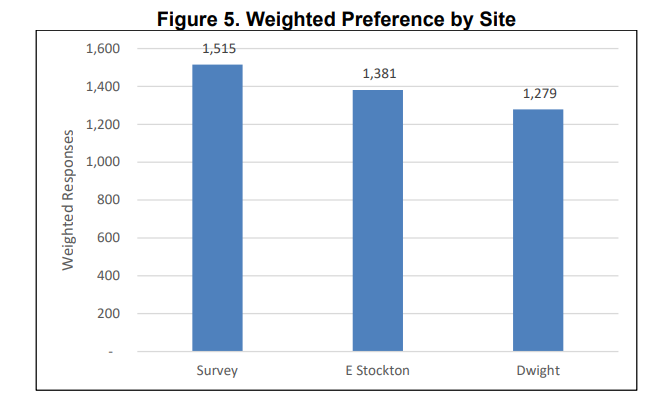

The meeting lasted three hours.

Sergio Robles has campaign finance practices that are antithetical to his party's orthodoxy

“Last year, Big Oil spent big on lobbying in California – and it worked"

Even if the council settles on a preferred site, the project remains subject to property negotiations with landowners