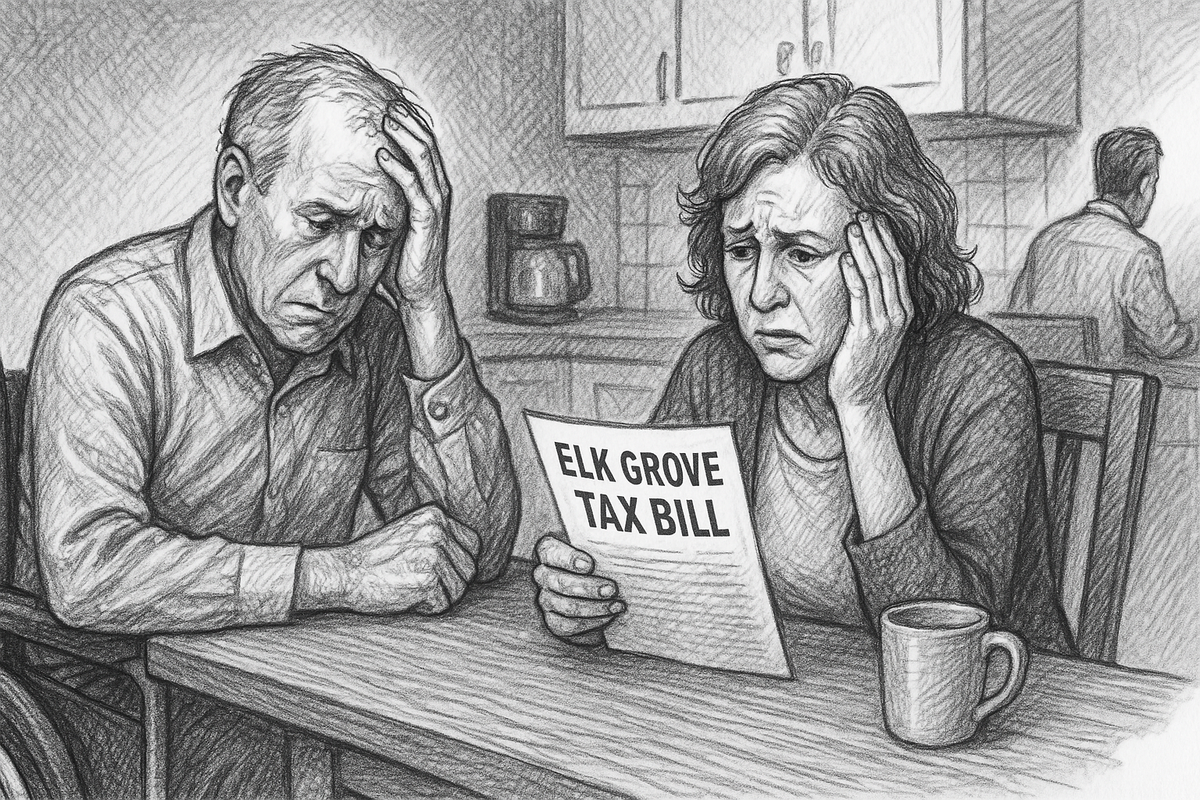

Mello Roos relief available for qualifying property owners in Elk Grove-EGUSD boundaries

While the Act itself doesn't mandate reductions for seniors or persons with disabilities, it provides the framework that enables districts like EGUSD to offer such relief.