Kohl's Retrenches as Ross Expands: A Tale of two retail strategies to playout in Elk Grove and California

Elk Grove considers itself a caviar and Dom Perignon champagne type of community.

Elk Grove considers itself a caviar and Dom Perignon champagne type of community.

The meeting lasted three hours.

Sergio Robles has campaign finance practices that are antithetical to his party's orthodoxy

“Last year, Big Oil spent big on lobbying in California – and it worked"

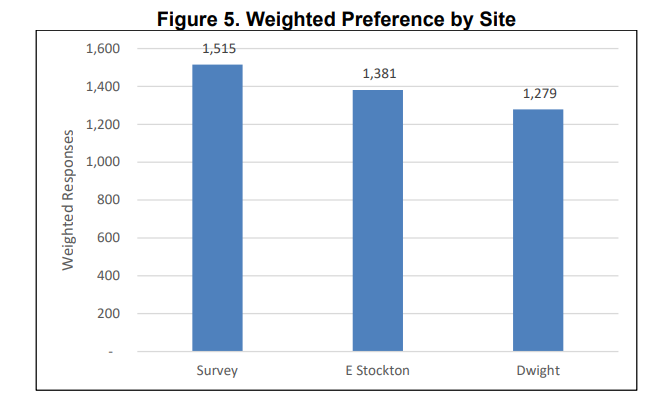

Even if the council settles on a preferred site, the project remains subject to property negotiations with landowners